top of page

Search

86. How to Pay Your Medical Expenses TAX FREE!

How to pay your medical expenses TAX FREE! Health Savings Accounts (HSA) Start saving more on healthcare. A Health Savings Account (HSA)...

Nov 28, 20227 min read

29 views

0 comments

85. Difference between E-File and Paper File

Over 82 million individual taxpayers file their taxes electronically in 2021, It is 92% of all U.S. Taxpayers! Why E-filing is so...

Nov 22, 20221 min read

16 views

0 comments

73. Penalties for Late Filing and Payment of Federal Taxes

If both a failure-to-file and a failure-to-pay penalty apply in the same month, the combined penalty is 5% (4.5% late filing and 0.5%...

Aug 12, 20222 min read

15 views

0 comments

72. It's Time to Start Your Own Business!

Start your own business! Starting your own business is one of the most powerful ways to take control of your life and make extra money....

Aug 10, 20222 min read

30 views

0 comments

70. Why You Should Pay Your Children Under Age 18?

In case you haven’t considered it, hiring your children may be the easiest and legitimate way to cut your taxes. In this article, I am...

Jul 26, 20222 min read

30 views

1 comment

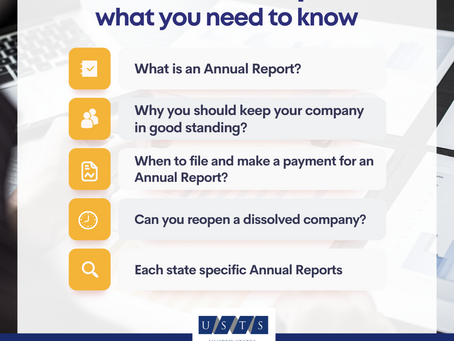

69. The Annual Report: What You Need to Know!

What is an Annual Report? An Annual report is necessary because it keeps the company in good standing status as a registered entity. In...

Jul 21, 20222 min read

97 views

0 comments

68. What is Payroll?

If you are a business owner, no matter what business you’re in, you probably have or will have employees. In general, Payroll is payments...

Jul 21, 20224 min read

59 views

0 comments

67. Don’t Waste Money on Penalties!

Don’t waste money on penalties! Penalties apply when you owe taxes or did not file a tax return or extension. Keep in mind that the...

Jun 22, 20221 min read

21 views

0 comments

66. 1040x Amended (Corrected) Tax return. True Stories (All names are changed)

Important! You can correct your taxes for the last three years! Story 1 Clients Alice and Erik came to our office with a recommendation...

Jun 16, 20224 min read

19 views

0 comments

65. Why the IRS Audits You and What to Do if You Are Audited?

If you just received a notice that your taxes are being audited: what does it mean? A Tax Audit is an accounting procedure where the IRS...

May 13, 20224 min read

22 views

0 comments

64. Have you got a letter from the IRS? Don’t ignore it. Don’t panic and act on time.

What to do: Verify why exactly the IRS sent you a letter. The agency categorizes notices to: – information letters (the agency wants to...

May 12, 20221 min read

14 views

0 comments

63. I Made a Mistake on My Tax Return, What Should I Do?

You must file an amended tax return entering the corrected info and an explanation of why are you changing your report. Based on the...

May 11, 20221 min read

19 views

0 comments

59. Taxpayers should file their tax returns on time to avoid costly interest and penalty fees

Taxpayers should file their tax returns by the deadline even if they cannot pay their full tax bill. Taxpayers who owe taxes and don't...

Apr 1, 20222 min read

10 views

0 comments

57. Tax optimization with 401K Solo MUST have payroll!

Get ready to launch a solo 401(k) retirement plan Most contributions and other limits for retirement plans only budged slightly for...

Feb 26, 20223 min read

15 views

0 comments

56. Error in form W2 or 1099?

Substance over form. Have you received a W-2 or 1099 with an error? Check forms carefully to ensure accuracy. If you discover a mistake,...

Feb 25, 20221 min read

17 views

0 comments

55. It’s Time to Finalize your Taxes!

It is now mid-January and you should be receiving all of your tax forms shortly or you may already have them. If you have everything you...

Feb 21, 20221 min read

10 views

0 comments

53. Low-Income Taxpayer

Low-incomers needn't pay back credit overpayments. But others will have to. Families with 2021 modified adjusted gross incomes at or...

Feb 19, 20221 min read

19 views

0 comments

52. Protection PIN for Individuals

IRS wants more individual taxpayers to get identity-protection PINS as extra protection from tax identity theft. The IP PIN is a...

Feb 18, 20221 min read

20 views

0 comments

51. Child Tax Credit

The monthly child credit payments aren't taxable. On your 2021 Form 1040, which you file next year, you'll reconcile the payments you got...

Feb 17, 20221 min read

13 views

0 comments

43. Are You an Independent Contractor or an Employee?

It is critical that business owners correctly determine whether the individuals providing services are employees or independent...

Feb 1, 20223 min read

25 views

0 comments

bottom of page